Description

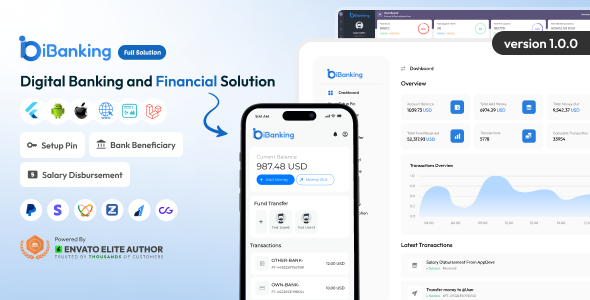

iBanking – Digital Banking and Financial Solution

iBanking – Digital Banking and Financial Solution designed to simplify everyday banking tasks and offer a seamless financial experience. With a sleek, user-friendly interface, iBanking empowers users to manage their finances efficiently, perform transactions, track investments, and access a wide range of financial services. Whether for personal banking or small business management, iBanking offers cutting-edge tools and features to keep users in control of their financial world.

Key Features of iBanking

1. Comprehensive Digital Banking Services:

- Account Management: View balances, transaction history, and account statements in real-time.

- Money Transfers: Easily transfer funds between accounts or to third-party accounts with secure payment processing.

- Bill Payments: Pay utilities, credit cards, and other bills directly through the app for quick, hassle-free payments.

2. Advanced Financial Tools:

- Investment Tracking: Monitor stock portfolios, mutual funds, and other investments with up-to-date performance reports.

- Budget Management: Track expenses, set savings goals, and create monthly budgets to stay on top of finances.

- Loan Management: Apply for personal loans, track loan status, and manage repayment schedules through the app.

3. User-Friendly and Secure Interface:

- Intuitive Dashboard: A clean and organized dashboard for easy access to essential banking features.

- Biometric Security: Utilize fingerprint or face recognition for secure and fast login to protect sensitive financial data.

- Two-Factor Authentication: Add an extra layer of security for all transactions and account access.

4. Cross-Platform Access:

- Mobile App Compatibility: Full functionality on both iOS and Android devices for convenient on-the-go banking.

- Desktop Access: Web-based version for easy access to banking services from your computer.

- Seamless Synchronization: Sync accounts, transactions, and settings across multiple devices for a consistent user experience.

5. Real-Time Alerts and Notifications:

- Transaction Alerts: Receive push notifications for deposits, withdrawals, and bill payments.

- Fraud Prevention: Get immediate alerts for suspicious activity or security breaches to protect your accounts.

- Customizable Notifications: Set preferences for the types of notifications you want to receive.

6. Customizability and Scalability:

- Editable Source Code: Modify features, UI components, or integrations to meet specific business or personal banking needs.

- Responsive Design: Optimized for mobile phones, tablets, and desktops with responsive layouts for any screen size.